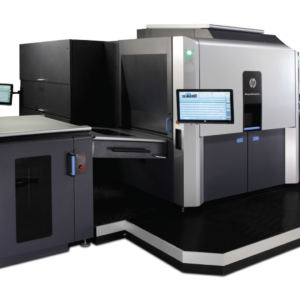

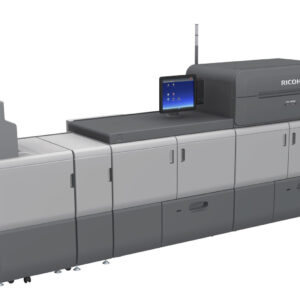

We are looking to buy the following machines:

Featured Videos

A Message From JJ Bender

A Message from Jeffrey Bender: Founder of JJ Bender

Customers & Partners,

We are getting BIGGER! What does that mean? In short we now deal in the biggest equipment in the digital & printing world. We work with ink jets to color presses including Igens, HP Indigo, Nexpress’ etc.

We help the biggest companies in the printing & mailing world. But the BIGGEST thing of all is our ability is to pay exquisite attention to ALL of our customers or partners we do business with no matter what size.

How do we help you get bigger and respond to what you need today?

Do you need:

- To sell equipment?

- Leasing for any products?

- To buy equipment?

- Help with service?

It’s not what we want to sell- it’s all about what is going on in your world! So call and you will reach someone who has worked here for 15-20 years. BIGGER and BETTER is what we wish for you- so let’s find out how we can make money together for the rest of 2020 and the future.

Warmest regards,

Jeffrey Bender

Founder